Written: November 2024.

Last Updated: August 2025.

As a summary, here are the new 2025 guidelines for the revamped MM2H set out through the 3 tiers, namely, Platinum (with the most beneficial terms comes the highest deposits), Gold & Silver as well as the Special Financial/Economic Zones and the respective benefits and financial requirements simplified below.

I assume you will work with a consultant who will walk you through the administrative details so I skipped those details and focused on the main questions at the back of the minds of my foreign clients.

PLATINUM:

The applicant needs to place USD1,000,000/- in a Fixed Deposit in a bank in Malaysia in exchange for a 20-year visa for the applicant and dependents.

GOLD:

The applicant needs to place USD500,000/- in a Fixed Deposit in a bank in Malaysia in exchange for a 15-year visa for the applicant and dependents.

SILVER:

The applicant needs to place USD150,000/- in a Fixed Deposit in a bank in Malaysia in exchange for a 5-year visa for the applicant and dependents.

SPECIAL FINANCIAL & ECONOMIC ZONES:

The applicant needs to place USD65,000/- (Applicants 21 to 49 years)/USD32,000/- (Applicant 50 years and above) in a Fixed Deposit in a bank in Malaysia in exchange for a 10-year visa for the applicant.

OTHER REQUIREMENTS & BENEFITS:

Compulsory Property Purchase

Within a year of the visa’s endorsement, the applicant must purchase a residential property with a minimum value set by the respective category of MM2H visa under Silver, Gold and Platinum.

Whereas under Special Economic/Financial Zone (SEZ/SFZ), the property purchase has to be made before endorsement of MM2H Visa.

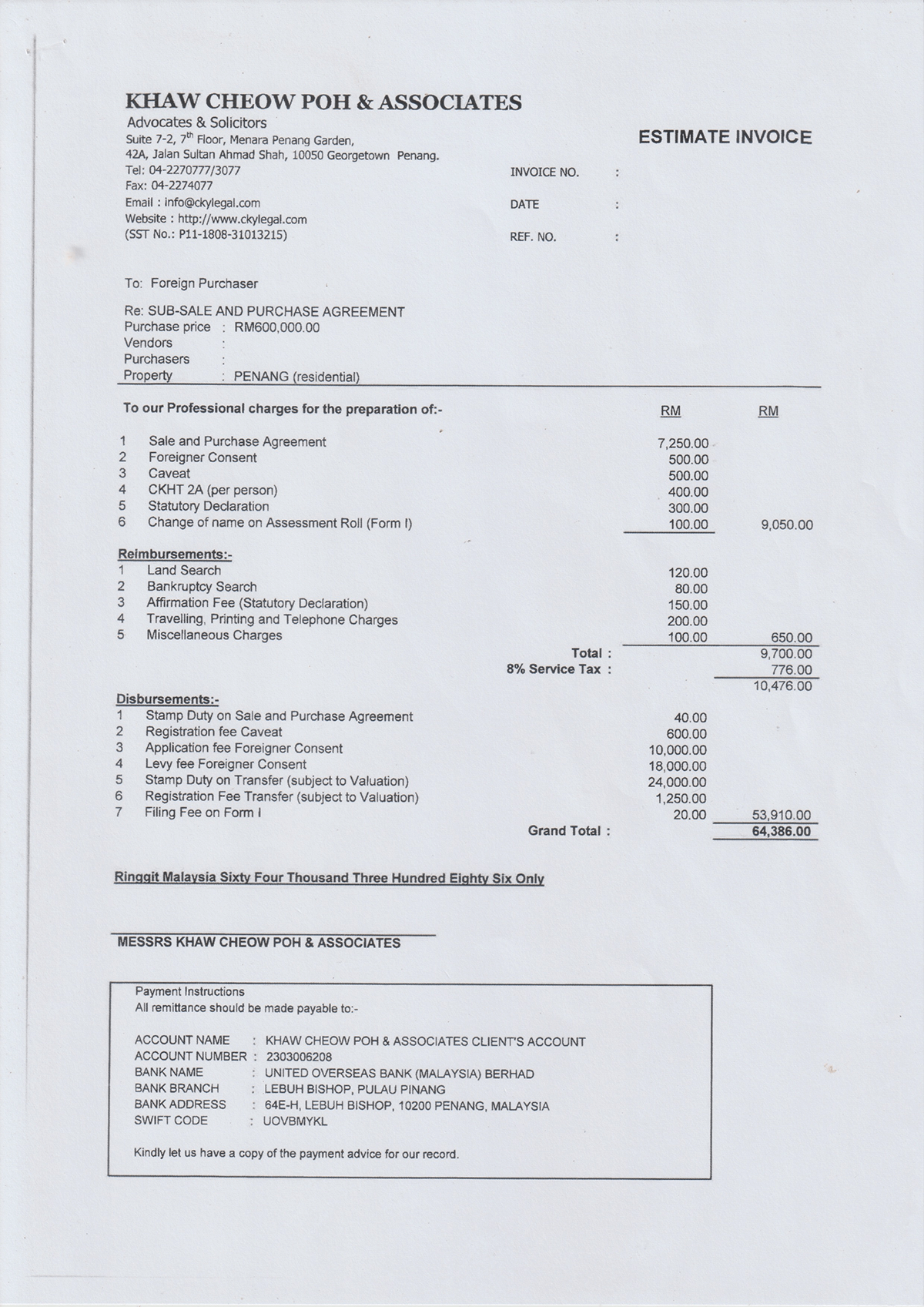

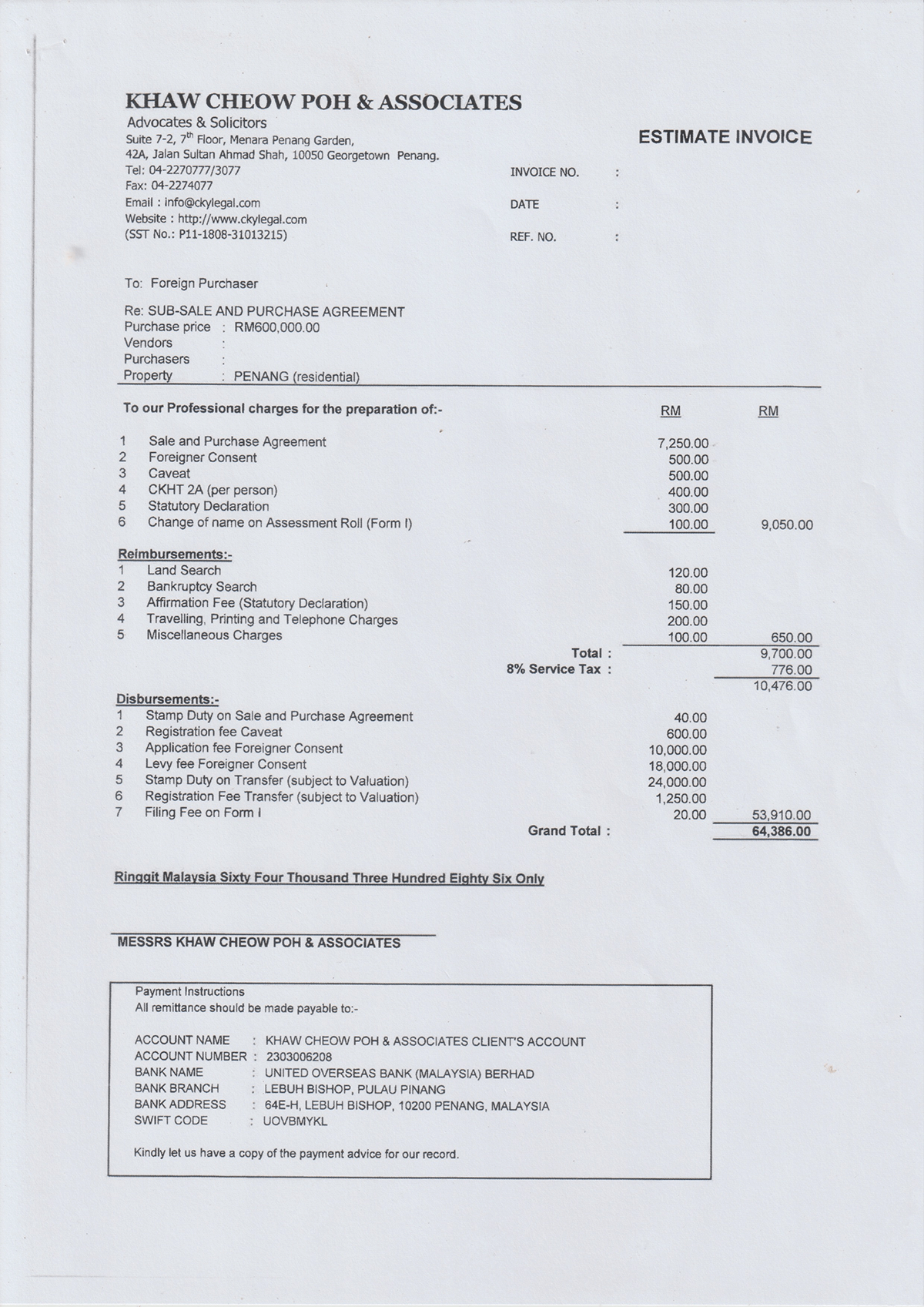

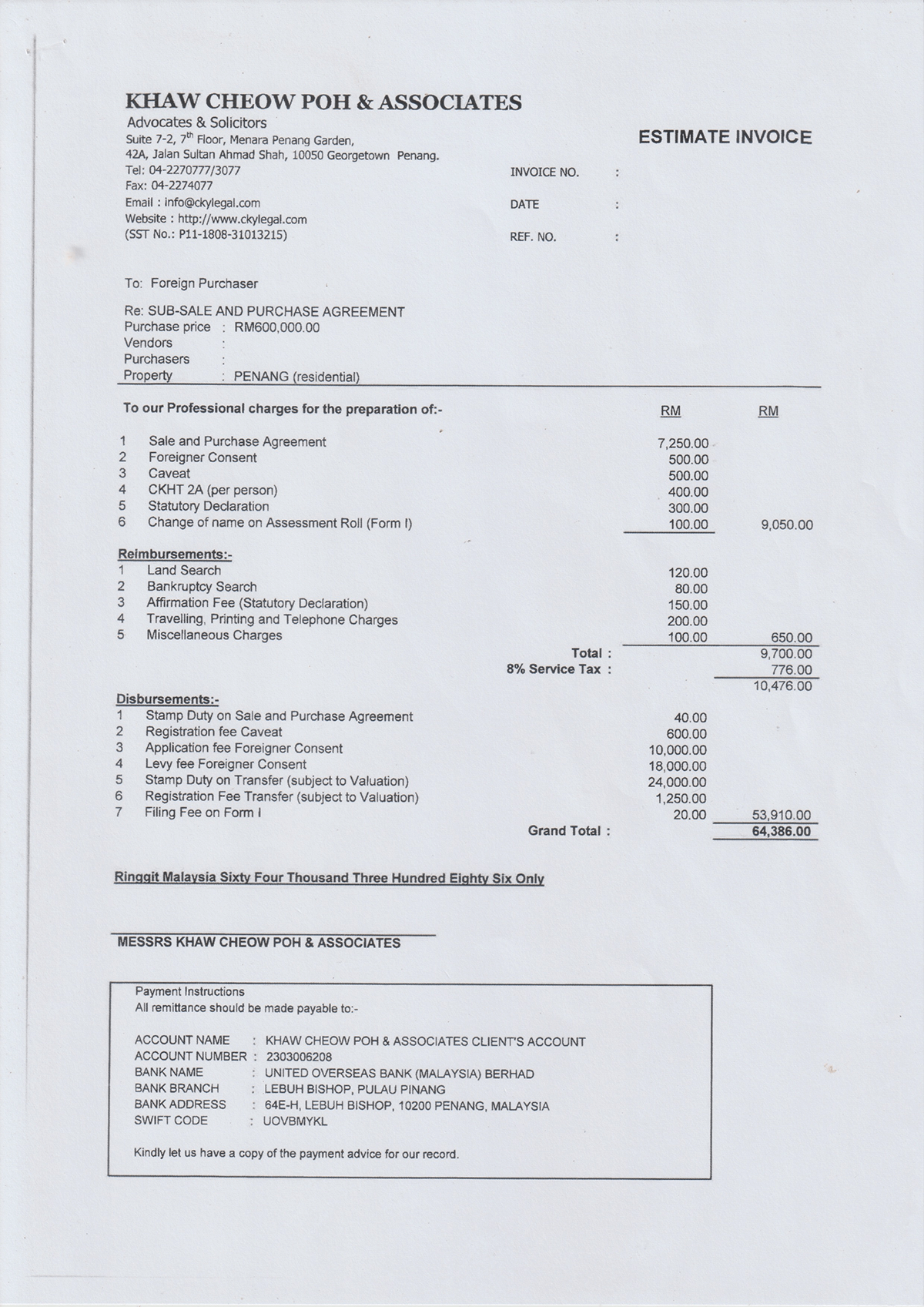

As we are a law firm, our conveyancing fees are governed by the Solicitors Remuneration Order 2023 (“SRO”). The SRO determines fees based on a percentage of the value of the property being transacted. See examples of Property Sales & Purchase fees here.

Withdrawals

After a year, up to half the Fixed Deposits can be withdrawn for the purchase of property, healthcare, education and tourism within Malaysia. Withdrawal of the Fixed Deposits (FD) are based on reimbursement upon furnishment of receipts.

Under Silver, Gold and Platinum, property that was purchased within two (2) years prior to the visa issuance date can be used for the withdrawal of 50% of the FD.

As for the SEZ/SFZ, property purchased six (6) months prior to the visa issuance date can be used for withdrawal of the 50% of the FD.

Minimum stay

There is a minimum stay in Malaysia of 90 cumulative days per year. For pass holders between the ages of 25 to 49 years (For the Platinum, Gold & Silver) and 21 years to 49 years (For the Special Financial/Economic Zone), this is considered fulfilled if either the principal pass holder or his dependents stay the 90 days.

Dependents

The successful pass holder can bring with him the following dependents:

- Spouse.

- Biological child/stepchild/adopted child up to 21 years old and if they do not work or are unmarried this can be extended to age 34 years.

- Children with disability with no age restrictions.

- Parents and/or parents-in-law (Previously there was a limit of 60 years and above. This is noticeably absent from the latest criteria. Although we have been verbally informed there is no such limitation in the revamped criteria, we think this is worth double checking this is an important criterion for you).

APPLICATION STAGE – What Are The Requirements?

What do you need to qualify? As with most countries, our wish list is to have applicants who benefit our country and are not a drain on our resources. Not surprisingly, the main criteria at the application stage is a Letter of Good Conduct (LOGC).

LOGC

This is the letter of good conduct which is typically obtained from the authorities such as the police in the applicant’s country of residence. As the name suggests, this serves to show that an applicant is a person of good standing.

POST APPROVAL STAGE – What Are The Requirements?

Fixed Deposit

The final step in the process is to have your passport and those of your dependents stamped with the MM2H Visa approval.

Prior to this, the applicant would need to open an account with a bank in Malaysia and place a fixed deposit in the amount required by the relevant MM2H category for the duration of the MM2H Visa.

Up to 50% of the fixed deposit can later be withdrawn for purposes such as property purchase, medical or education expenses & domestic tours in Malaysia.

Security Bond

This ranges from RM200 to RM2,000 depending on your nationality and is paid to the Immigration Department as security.

Medical & Health Insurance

A medical check-up with a doctor in Malaysia is a pre-requisite for a passport endorsement as well as having valid health insurance for applicants who are below 60 years old.

The salient terms highlighted above should give you a good grasp of the revamped MM2H criteria.

For further information, continue reading.

On December 13th, 2023, the Minister of Tourism unveiled the broad strokes of the revamped MM2H programme, introducing a 3-tier system.

This revamp has been long overdue, so at the end of 2023 I wrote a commentary on the revamped MM2H programme based on the information available at the time.

At about the same, I also wrote a piece on when I expected implementation of this revamped MM2H Programme and also warned of teething issues.

The gist of what I said was not to hold your breath and also to expect a period of finetuning after this programme was implemented. I would consider having relatively clear guidelines and the acceptance of applications for processing by the authorities to be “Implementation of the new revamped MM2H Programme.”

About 2 to 3 months ago, the Ministry started vetting applications by candidates to become licenced agents and about a month ago agents started obtaining their licences. Then came this recent article where the Minister of Tourism was reported to have confirmed the relaunch of the revamped MM2H Programme and that applications have been accepted by the One Stop Centre Malaysia My Second Home at the Ministry of Tourism.

My checking of the Ministry webpage further confirms the guidelines have been published.

Based on this, I believe the benefit of the doubt can be given to the Ministry of Tourism, Arts & Culture and that the revamped MM2H Programme has indeed been implemented.

Why am I, proverbially speaking, late to the MM2H commentary party?

Although one can never be 100% sure, I wanted to be as certain as possible that the criteria have been fully accepted by the stakeholders (Since the initial announcements at the end of 2023, there have been lobbying and feedback resulting in certain criteria being dropped and new ones added) so that when this goes on to my page, it doesn’t have to be revised.

That being said, I do want to remind the reader that the implementation stage will be followed by the finetuning stage resulting in some possible adjustments to the programme. Hopefully, these will be administrative in nature and there will be no changes to the main criteria.

With the caveats out of the way, let’s start.

Instead of regurgitating what has been widely reported in the press (Being late to the Party has its advantages and I’ve been able to review what my respected peers have penned!), I’m going to make a commentary here based on the needs of a potential foreign applicant researching a possible relocation to Malaysia under MM2H. I have also gone through the numerous questions which were posed to us in the FAQ section of my website as well as by our immigration clients for this purpose.

What is the revamped MM2H?

In a nutshell, the revamped MM2H is a long-term visa which allows the successful applicant 25 years old and above, their spouse, children under 35 years, and parents and/or parents-in-law, the right to remain in Malaysia for the duration of their visa or multiple entries and exits from Malaysia within the duration of the said visa.

The MM2H visa is in turn split into 3 visa tiers with varying durations and corresponding fixed deposit requirements in a Malaysian bank upon approval. It is open to all foreign citizens — aged 25 years and above — of a country that is formally recognized by Malaysia.

In addition to the 3 visa tier category, there is a further Special Financial/ Economic Zone MM2H which is a long-term visa allowing successful applicants 21 years old and above, their spouse, children under 35 years, and parents and/or parents-in-law, the right to remain in Malaysia for the duration of their visa or multiple entries and exits from Malaysia within the duration of the said visa.

Aside from the lower mandatory fixed deposit rate and minimum applicant’s age, the remaining criteria are similar to the Gold/Silver conditions. The exception, as the name suggests, requires the mandatory property purchase to be in the Financial/Economic Zone.

For practical purposes, this is in the Forest City area in Johor and the properties must be purchased from a developer and must be purchased before endorsement of the MM2H visa.

All categories of the revamped MM2H are overseen by the Ministry of Tourism and Home Office (Immigration Department).

Please refer to the table below for the detailed breakdown comparing the various versions of MM2H in Malaysia, including the Sabah & Sarawak versions.

PROS

Purchase of residential property at a lower financial threshold

This is a bonus for applicants who plan to own a property in Malaysia. Foreigners are generally only permitted to purchase certain types of higher-end properties (usually foreigners are allowed to purchase properties with a value of RM1,000,000 and above).

In certain states and for applicants in the Silver and Special Economic/Financial Zone categories, the financial threshold for property purchase is lower than the RM1,000,000 threshold. Each state and/or Special Economic/Financial have their respective thresholds.

For example, Penang permits MM2H holders to purchase up to 2 residential properties as low as RM500,000. However, under the MM2H minimum tier, purchase must be RM600,000 and above according to the value set by the respective category of MM2H visa.

An application to the State Authority in which the property is located is required for purchase by foreigners. Malaysia has clear laws on property ownership and is one of the few countries in the region allowing foreigners to own freehold landed properties.

Please take note that Malaysia is a federation of states and each state has their own autonomous guidelines, so check with your legal adviser or contact us before committing to a purchase to avoid any legal issues.

As we are a law firm, our conveyancing fees are governed by the Solicitors Remuneration Order 2023 (“SRO”). The SRO determines fees based on a percentage of the value of the property being transacted.

Here are 3 examples of fee structure from a Property Sale & Purchase Agreement for properties in Penang:

Family

Dependents such as the main applicant’s spouse (of the opposite sex), parents and/or parents-in-law, single children (biological, adopted or step) under 35 years (Children between the ages of 21 to 34 must be single and not working), or children medically certified as having disabilities regardless of age, can join. Previously there was a limit of 60 years and above for parents.

This is noticeably absent from the latest criteria. We have been verbally informed there is no such limitation in the revamped criteria and furthermore, both parents and parents-in-law can come in as dependents.

Nonetheless, we think this is worth double checking if this is an important criterion for you.

Use of the Priority Lane at KLIA & Penang airports

This is probably not a determining factor for the MM2H applicant but would no doubt be appreciated coming off a long flight and being able to pass through the immigration relatively quickly.

Change of Principal

In the event of the death of the principal, the MM2H pass of the deceased is transferable to the next of kin among the registered dependents.

This is likely to be a significant improvement to the previous MM2H passes where the authorities are entitled to require the replacement candidate to show a minimum proof of funds.

This may be a stumbling block to retirees who may not be able to show liquid cash or income.

Tax

Malaysia has a source-based or territorial taxation system. At the moment exemption is given to foreign-sourced income (except income from a partnership business in Malaysia) received in Malaysia from outside Malaysia on condition that the tax payment in the country where the foreign-sourced income is derived, if any has been paid in accordance with the laws of the relevant foreign country.

This exemption is up till 31st December, 2026 in accordance with the Income Tax (Exemption) (No. 5 & 6) Order 2022. Notwithstanding this, the Minister of Finance has proposed in the recent 2025 budget speech that this be extended till 31st December 2036.

The annual budget is made at the end of October each year. Keep a lookout for this if tax is an important point for you.

Notwithstanding the above, I wanted to elaborate that the above order relates to income.

Therefore it should not apply to foreign funds coming into Malaysia which are not income in nature. For example, if a foreign MM2H visa holder breaks his fixed deposit in a bank in Singapore and wires it into his bank in Malaysia there should be no tax payable in Malaysia.

Understandably, this is a technical area of Malaysian tax law and we are not experts so if this is an area of concern do consult with a Malaysian tax adviser.

Tax Identification Number or TIN

Foreigners can apply for TIN. However to be a Malaysian tax resident, they need to stay in Malaysia for 182 days or more.

Lifestyle

Malaysia offers a safe and welcoming environment where a low cost of living, good schools and world-class medical care (a significant number of our doctors and professionals are trained in the UK, USA, Australia, and Hong Kong) are pull factors.

Being a fusion of East & West, non-medical care such as traditional Chinese medicine, chiropractic treatment and traditional healing massages are available at very affordable prices.

Most of my clients tell me that Malaysians are generally warm and hospitable, especially to foreigners. Some may say we are disorganized, sometimes unreliable, have a dysfunctional government, are tardy, and breakers of the occasional rules. I will concede that these may have a degree of validity, but the consensus amongst my foreign clients is that we are generally a welcoming bunch, to give credit where credit is due.

I believe Malaysia’s USP for foreigners is that it’s way easier to make lifelong friends in Malaysia, not only with other expatriates but also with my fellow Malaysians in addition to being able to lead a pampered lifestyle. Many of my clients take individual kickboxing, dance, music classes etc or join activity groups for running, cycling or enduro.

They lead very fulfilling lives not less than how they would live in their home countries.

CONS

Minimum stay requirement of 90 cumulative days per annum for applicants between the age of 21 & 49 years

This may present a problem for some applicants who need to spend time elsewhere for whatever reasons. Happily, this minimum stay requirement can be fulfilled by combining the stay periods of the applicant and his/her dependents.

Notwithstanding this, we are told that the main applicant must at least spend some time in Malaysia and not wholly rely on his dependents’ stay.

There are no minimum stay requirements for applicants above 49 years.

Financial Requirements

Although the new fixed deposit amounts are substantially lower than the mandatory fixed deposit amounts in the MM2H programme being replaced, it is still an outlay of funds, albeit a refundable one, therefore I have placed this under the “Cons” category.

Interest-bearing fixed deposits, the amount of which correlate with the relevant category have to be placed in a bank in Malaysia for the duration of the visa.

Please refer to the table for the amounts. Up to 50% of these fixed deposits may be withdrawn for the purchase of a residential property, education, medical and tourism in Malaysia.

Potential applicants for the revamped MM2H who find the financial criteria too restrictive can consider other visas such as the Guardian visa (If you have a child studying in an international school in Malaysia) or Sarawak MM2H.

Purchase of Property Requirement

Under Silver, Gold and Platinum, there is a requirement for the successful applicant to purchase a residential property within 1 year after MM2H visa endorsement and as for the Special Economic/Financial Zone (SEZ/SFZ) the property has to be purchased before endorsement of MM2H visa and this property cannot be sold for 10 years.

Officially, it is stated the property can be sold if the applicant wishes to purchase another property of a higher value. I believe, although this has yet to be confirmed, the property can be sold if the applicant terminates his visa.

The applicant is entitled to withdraw 50% of the fixed deposit under lien for payment of the property purchase price.

If an applicant already owns a property, the property can be used for compliance with this requirement. However, the value of the property must be according to the threshold of each category.

The applicant using his pre-existing property to comply with this requirement is entitled to withdraw from the Fixed Deposit under lien provided the Sales & Purchase Agreement was signed within 2 years prior to the issuance of the MM2H visa. The purchase of residential property can be purchased from developers or secondary markets anywhere in Malaysia.

For applicants of the Special Economic/Financial Zone, at the moment, the residential properties accepted is Forest City, and can only be purchased from developers before endorsement of MM2H visa.

For withdrawing of 50% Fixed Deposit under SEZ/SFZ, the signing date of the Sales & Purchase Agreement has to be signed within six (6) months prior to the issuance of MM2H visa.

Not allowed to work/invest in companies in Malaysia

Save for the Platinum Category where working and investing in companies in Malaysia is allowed, applicants in the Gold, Silver and Special Financial/Economic zones are not accorded these privileges.

Understandably, MM2H visa holders are not permitted to work, although I can’t see the logic of not allowing MM2H holders to start companies or be part owners of companies which in turn employ Malaysians and contribute to the local economy.

I had hoped this would be withdrawn and I had waited before writing this article to see if this would happen. Unfortunately, it does look like it’s going to stay for now.

If you wish to work, there are various other visas you can consider. such as the MDEC Nomad/Tech Entrepreneur visas (If you are a digital nomad and want to work as one in Malaysia/invest in a tech company in Malaysia), Employment passes through the setting up of a Labuan or a company in Peninsular Malaysia.

I hope this article managed to filter out the noise and outline the main points in the revamped MM2H Programme.

If you need further information, please feel free to email me at sam@ckylegal.com